Homeowners Insurance in and around Greenville

Homeowners of Greenville, State Farm has you covered

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

Home is where family gathers memories are created, and you're protected with State Farm's homeowners insurance. It just makes sense.

Homeowners of Greenville, State Farm has you covered

Help protect your home with the right insurance for you.

Protect Your Home Sweet Home

State Farm's homeowners insurance secures your home and your possessions. Agent John Simmons is here to help develop a policy with your specific needs in mind.

Terrific homeowners insurance is not hard to come by at State Farm. Before the unanticipated occurs, get in touch with agent John Simmons's office to help you put together the right home policy for you.

Have More Questions About Homeowners Insurance?

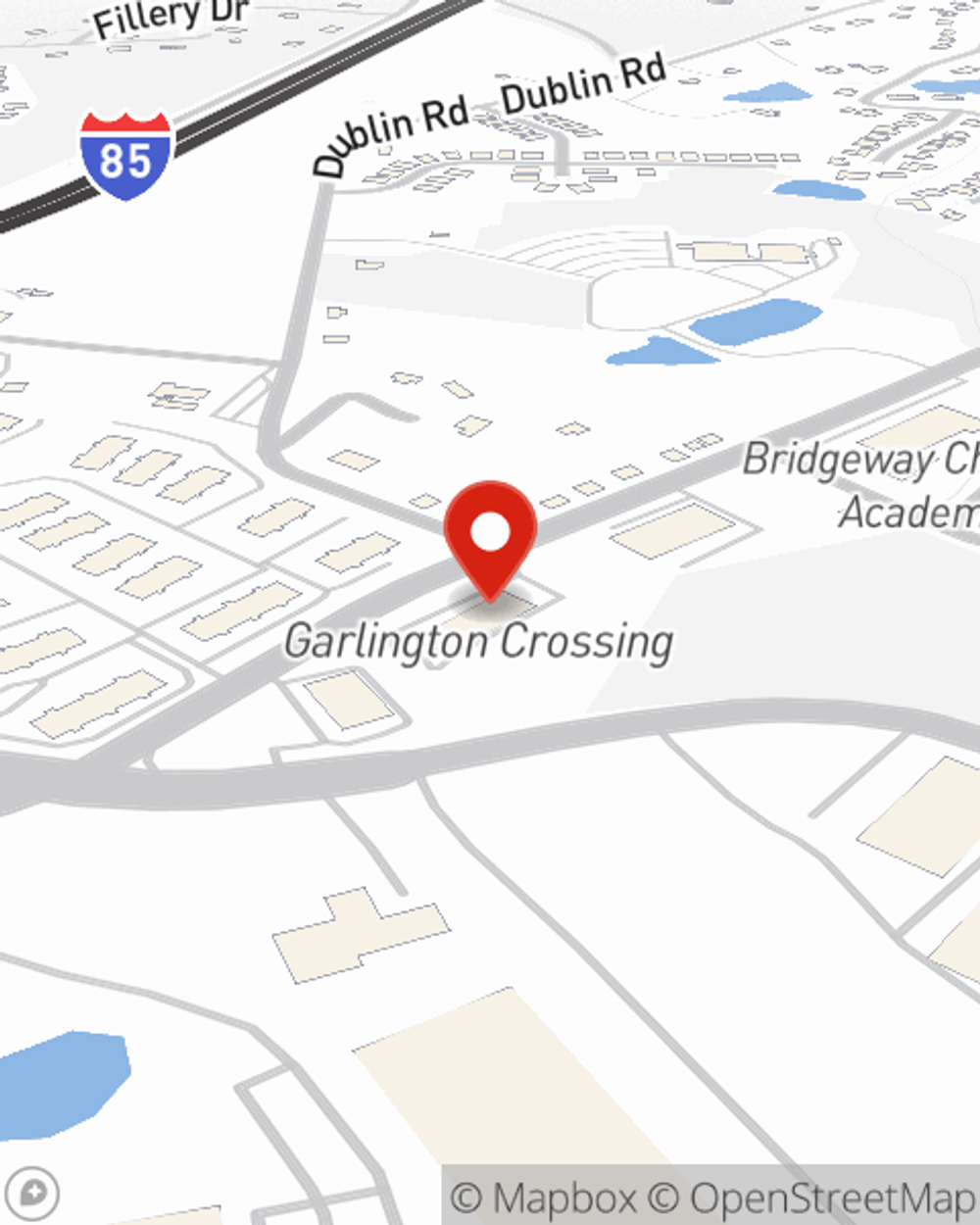

Call John at (864) 234-8455 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Clothes dryer maintenance tips

Clothes dryer maintenance tips

These simple tasks can help extend the life of your dryer. Find out how to clean the inside of a dryer, how to clean your dryer vent and more.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

John Simmons

State Farm® Insurance AgentSimple Insights®

Clothes dryer maintenance tips

Clothes dryer maintenance tips

These simple tasks can help extend the life of your dryer. Find out how to clean the inside of a dryer, how to clean your dryer vent and more.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.